On 12 February, Israeli authorities indicted an army reservist and a civilian for using secret operational information to bet on the Polymarket platform.

This unprecedented case raises a fundamental question about the future of modern warfare security in the digital age.

The indictment followed a months-long investigation. In January, Israel's Kan News TV reported that security agencies were investigating suspicious betting ahead of Israel's attack on Iran during the June 2025 12-day war.

A statement from the Ministry of Defence, the Shin Bet (internal intelligence and security service), and the Israeli police confirmed that several people had been arrested, while two were charged with serious security violations, bribery, and obstruction of justice.

The names and specific bets have not been released, but it is clear that the reservist had access to classified information through his military service and shared it with a civilian.

The Office of the State Attorney requested that the defendants remain in custody throughout the court proceedings.

The Israeli Armed Forces called the case "a grave ethical failure and a clear crossing of a red line", although they claim that no operational damage was caused.

That claim is problematic in itself. If someone could profit from secret information, it logically follows that the enemy could also notice unusual betting activity and draw conclusions about upcoming actions.

Joseph Grundfest, a former Securities and Exchange commissioner and now a law professor at Stanford, put the problem directly: "Such bets can put your own military at greater risk because you are signalling to your enemies what may happen, and that puts your own troops in danger."

A magnet for controversial betting

Polymarket is not an ordinary bookmaker. The platform allows users to trade cryptocurrencies on the outcomes of future events.

Currently, there is active betting of $239 million on the platform on the question of when the US will attack Iran. The trading volume is huge, and the motivation for manipulation is clear.

However, the platform itself operates in a regulatory grey area. Polymarket is based outside the United States, placing it beyond the reach of US regulatory authorities.

Unlike its competitor Kalshi, which is registered with the Commodity Futures Trading Commission (CFTC) and must comply with rules prohibiting betting on wars, terrorism, and assassinations, Polymarket faces no such restrictions.

This makes it, in Grundfest's words, "a magnet for some of the most controversial kinds of prediction market wagers."

The problem with Polymarket is not only regulatory. In January, an unknown trader turned $32,000 into $400,000 by correctly predicting that the US military would overthrow Venezuelan President Nicolás Maduro before the operation was made public.

Bets were placed just hours before the operation became public knowledge. A wave of suspicions about the misuse of military information arose immediately, but the American authorities made no comment.

The story becomes even more complicated. The second Trump administration dropped the Biden administration's legal disputes against Polymarket and Kalshi, promising to defend the industry's right to exist.

In 2022, the FBI raided the home of Polymarket CEO Shayne Coplan and shut down the company's US operations, forcing it to block access to US users.

Now, the direction has changed. In August 2025, Polymarket paid $112 million to acquire the US stock exchange QCEX, allowing it to legally return to the US market.

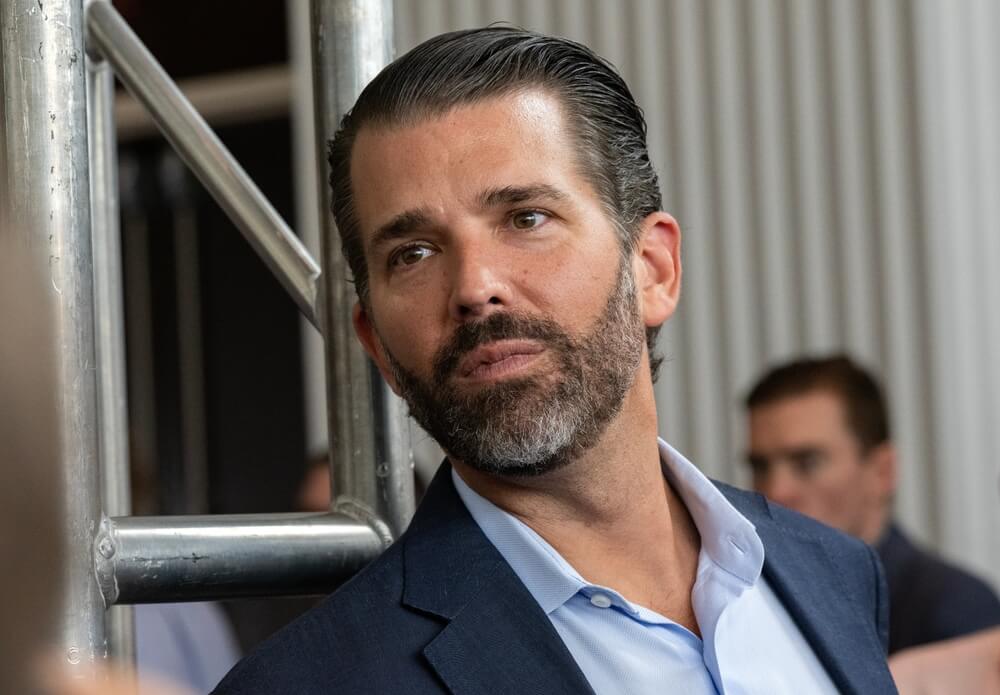

Polymarket cuts through media spin and so-called 'expert' opinion by letting people bet on what they actually believe will happen in the world - Donald Trump Jr.

Polymarket cuts through media spin and so-called 'expert' opinion by letting people bet on what they actually believe will happen in the world - Donald Trump Jr.

At the same time, Polymarket received a strategic investment from the 1789 Capital fund, whose partner is Donald Trump Jr.

The amount was not disclosed, but Axios reports it is in the "double-digit millions of dollars." Trump Jr also joined Polymarket's advisory board.

Previously, in January 2025, Trump Jr became a strategic advisor to rival platform Kalshi, placing him in the unusual position of advising two of the industry's biggest competitors.

His fund, 1789 Capital, has also invested in Polymarket, while Trump's social network, Truth Social, plans to launch its own prediction market service called Truth Predict.

The conflict of interest is clear. Critics point out that the Trump administration allows prediction market platforms to operate with lax regulations because the Trump family benefits financially.

The official explanation is different. Trump Jr stated, "Polymarket cuts through media spin and so-called 'expert' opinion by letting people bet on what they actually believe will happen in the world."

Omeed Malik, founder of 1789 Capital, adds, "Polymarket stands at the intersection of free expression and financial innovation."

When prediction markets turn state secrets into private profits

However, the Israeli case raises an issue far more serious than regulation. What happens when a prediction market becomes an infrastructure for converting state secrets into private profits?

Traditional intelligence services have monitored financial market irregularities for years as indicators of possible insider influence.

For example, an unusually large purchase of put options (bets on falling stock prices) on airline companies just before 9/11 triggered years of investigations, which ultimately did not prove a terrorist connection. But prediction markets are different.

They are decentralised, operate using cryptocurrencies, and often allow trading under pseudonyms.

Defence arguments will likely assert that the information was already available to the public through other channels.

Lawyers for the defendants have stated they have "strong claims" regarding the indictment, including "deficiencies in it, selective enforcement of the law, and inappropriate conduct by investigative authorities."

They claim the case will end "completely differently than it started." This is a standard defence strategy, but the point remains: if it is possible to make hundreds of thousands, even millions, of dollars on information that was supposedly already public, why would anyone choose to gamble on the stock market when they can simply place a crypto bet?

In practice, insiders can systematically profit from secret information

Prediction markets claim to operate on a free information market. In theory, if enough people trade, the market should provide the best estimate of probability.

In practice, insiders can systematically profit from secret information. This is a known problem in traditional financial markets, where insider trading laws exist. However, prediction markets operate in a zone between financial regulation, gambling laws, and national security.

Polymarket currently has an estimated value of $9 billion. In February, the stock exchange group Intercontinental Exchange (which controls the New York Stock Exchange) pledged up to $2 billion in investment.

Investors have invested $300 million in Kalshi, valuing the company at $5 billion.

The prediction markets industry is becoming too large for regulators to ignore but also too politically connected to be easily controlled.

War is not fought only on the front lines

The Israeli case raises a question that no army in the world has yet solved: what should be done with soldiers who have access to classified information in an era when any event can be turned into a financial bet?

Conventional security training concentrates on preventing the enemy from obtaining information.

An Israeli soldier realised what many others with access to military secrets will soon realise: war is not fought only on the frontlines

An Israeli soldier realised what many others with access to military secrets will soon realise: war is not fought only on the frontlines

No one envisioned a scenario where soldiers sell a secret to the market, and the market then potentially signals to the enemy what is happening.

It is a security risk and an ethical breach that no one knows how to fix.

Prediction markets claim to operate on a free information market. In practice, they have become an exchange for state secrets.

An Israeli soldier realised what many others with access to military secrets will soon realise: war is not fought only on the frontlines.

It is also conducted in the markets, where secrets are turned into profits faster than commanders can protect them.

The question is not whether this will happen again, but how many times it has already happened without anyone being caught.