India has long benefited from geopolitical arbitrage, maintaining working relationships with Russia, the United States, and Europe.

But this delicate balancing act is now being tested by a series of policy shocks delivered by US President Donald Trump’s administration.

These disruptions, unlikely to ease anytime soon, raise a critical question: Can India retain its status as the world’s fastest-growing major economy?

The most urgent challenge facing Indian policymakers is weathering the escalating trade war.

In August, Trump imposed a 50% tariff on Indian imports, citing the need to reduce India’s trade surplus with the US and punish the country for its massive purchases of Russian oil.

Adding to the pressure, Trump has urged the European Union and other G7 countries to take even harsher steps – namely, to impose a 100% tariff on imports from India and China.

Trump’s decision to hike H-1B visa fees to $100,000 represents yet another blow to India’s economy, particularly its IT services industry – one of the country’s most dynamic growth engines.

Currently, Indian nationals account for more than 70% of all H-1B holders, with most of them working in IT or technology-related sectors.

Given this, it’s hardly surprising that the share prices of Indian companies like Tata Consultancy Services, Infosys, and Wipro, which rely heavily on H-1B visas to access the US market, declined following Trump’s announcement.

A “dead economy”

While Trump has labeled India a “dead economy,” it is unclear whether he meant this as a statement of fact or a threat he will make good unless India offers sufficient concessions in its trade negotiations with the US.

Either way, there is little evidence to suggest the Indian economy is at risk of collapsing anytime soon.

On the contrary, India is among the world’s most vibrant economies. In July, before the new US tariffs were imposed, the International Monetary Fund projected that India’s GDP will grow by 6.4% in 2025 and 2026 – well ahead of America’s projected annual growth rate of 1.9%.

No other major economy comes close, with the exception of China, at 4.8%.

India is well-positioned to sustain its rapid growth rate over the next decade and become the world’s third-largest economy by 2030

Barring external shocks, India is well-positioned to sustain its rapid growth rate over the next decade and become the world’s third-largest economy by 2030.

Given its vast population and growth momentum, India could even overtake China and the US to emerge as the world’s largest economy within the next 50 years.

That said, the extent to which US policy shifts might affect India’s growth trajectory remains unclear.

The EU’s trade significance for India

In the early 2000s, India was far less exposed to global trade than China was, with exports accounting for less than 15% of its GDP, compared with China’s 20%.

Since then, however, India’s reliance on trade has increased significantly. Exports now make up more than 20% of GDP, leaving the country more vulnerable to trade shocks.

The EU’s trade significance for India nearly matches that of the US

Given that the US is India’s largest export market, Trump’s tariffs will likely hit harder than similar actions by other trade partners.

Still, it is important to remember that India is a continental economy, with domestic consumption playing a far greater role than external demand.

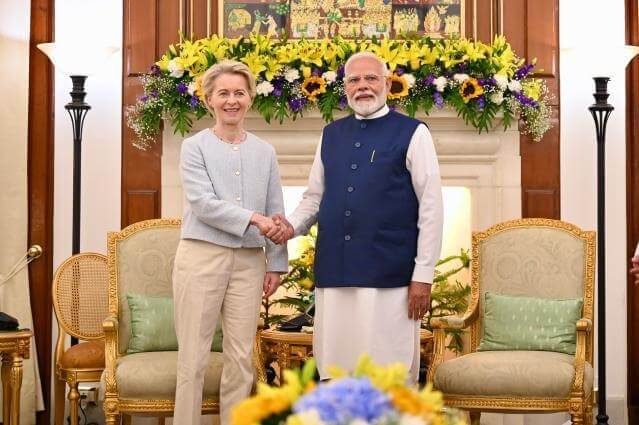

Moreover, the EU’s trade significance for India nearly matches that of the US, and China and the Middle East are also important export destinations. Consequently, while US tariff hikes are disruptive, they are far from fatal.

Structural reforms

This is not to say that Indian policymakers can afford to be passive. To mitigate the impact of US restrictions, they must pursue a dual strategy comprising stimulative macroeconomic policies and a concerted effort to deepen trade ties with the EU, China, and the Middle East.

The EU and China may well surpass the US as the world’s leading import destinations by 2028

The EU and China may well surpass the US as the world’s leading import destinations by 2028

It is also worth noting that the relative importance of the US market is likely to decline as a result of Trump’s protectionist trade policies.

Should his administration stay the course, the EU and China may well surpass the US as the world’s leading import destinations by 2028.

Beyond short-term policy responses aimed at offsetting the fall in US demand, the Indian authorities would be well advised to implement structural reforms.

Key priorities for sustaining long-term growth include raising the female labor-force participation rate from 33% to levels much closer to China’s 60%, improving the investment climate by tackling bureaucratic corruption, and upgrading infrastructure – roads, railways, ports, and airports – to lower the cost of production and trade.

By adopting these reforms, India will not only be able to weather Trump’s tariff war in the short term but also sustain its growth miracle for years to come.

Shang-Jin Wei, a former chief economist at the Asian Development Bank, is Professor of Finance and Economics at Columbia Business School and Columbia University’s School of International and Public Affairs.