All eyes were on Seoul, South Korea, this week, as Chinese President Xi Jinping met with US President Donald Trump to negotiate a framework for managing their economic relationship.

But, to understand China’s economic prospects, another recent meeting also warrants attention: the Fourth Plenary Session of the Communist Party of China, where China’s leaders adopted the CPC’s recommendations for the 15th Five-Year Plan for Economic and Social Development (2026-30).

The Fourth Plenum did not deliver the leadership overhaul that some expected.

Beyond the appointment of Zhang Shengmin as the second vice chairman of the powerful Central Military Commission – his predecessor He Weidong, along with ten other officials, was recently expelled from the CPC – little of note took place on the personnel front.

If anything, the meeting reaffirmed Xi’s dominance, reinforcing expectations that he will seek a fourth five-year term in 2027.

China’s economy has so far been coping relatively well with the Trump administration’s increasingly hostile measures, including high tariffs and export controls on high-tech products.

As noted in the communiqué issued at the Fourth Plenum, the CPC views the current Five-Year Plan as a success, and expects China’s GDP per capita to be on a par with that of a “mid-level developed country” by 2035.

Middle-income trap

Already, China may well have evaded the dreaded “middle-income trap,” which has ensnared so many developing economies in the past.

With gross national income (GNI) per capita having reached $13,660 in 2024 (at current prices), China is fast approaching the World Bank’s threshold for high-income status: $13,935 for the 2026 fiscal year.

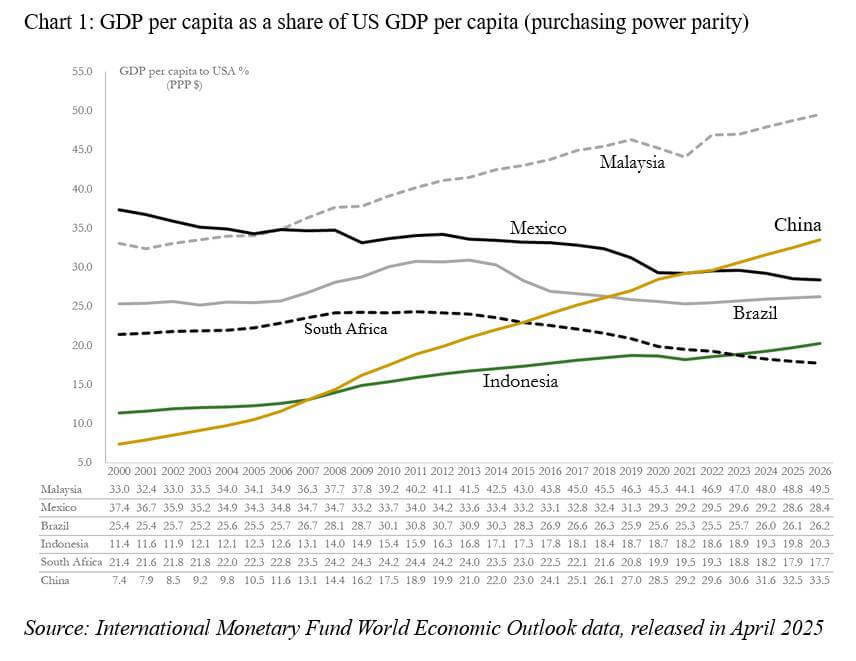

Another metric for determining whether a country has escaped the middle-income trap is GDP per capita, with the threshold set at 40% of the level in the United States, in purchasing-power-parity terms.

China has not quite gotten there yet, but as International Monetary Fund data show, it has been progressing fast – from 7% of US levels in 2000 to 17.5% a decade later to 32.5% this year.

If recent trends persist, that proportion will rise another percentage point in 2026, and reach the 40% threshold by 2035 – a similar trajectory to that of South Korea, which rose from 30% of US GDP per capita in the mid-1980s to 40% a decade later.

As Chart 1 shows, China’s trajectory contrasts with those of countries like Brazil and Mexico, which have remained stuck below the 40% threshold, and have even recorded a decline in GDP per capita, relative to the US, in recent years.

There is more good news. China has managed to increase domestic consumption – a key priority in both the 14th Five-Year Plan and the forthcoming 15th Five-Year Plan – from 49.4% of GDP in 2010 to 56.8% in 2023.

This will help it to continue reducing its dependence on exports, thereby increasing its economic resilience.

As it stands, China’s export-to-GDP ratio amounts to 20%, with the US accounting for 15% of total exports.

Weak domestic demand

But it will not be all smooth sailing for China in the coming years. Its economy is struggling with excess supply and weak domestic demand, though there are significant differences across regions.

Anecdotally, I noticed busy streets packed with bustling shoppers not only in central Shanghai, but also in Songjiang district on the city’s outskirts, as well as in the city of Nanjing, also located in the Yangtze River delta region.

The scene in Bengbu, and in the inland Anhui province, appeared far less dynamic.

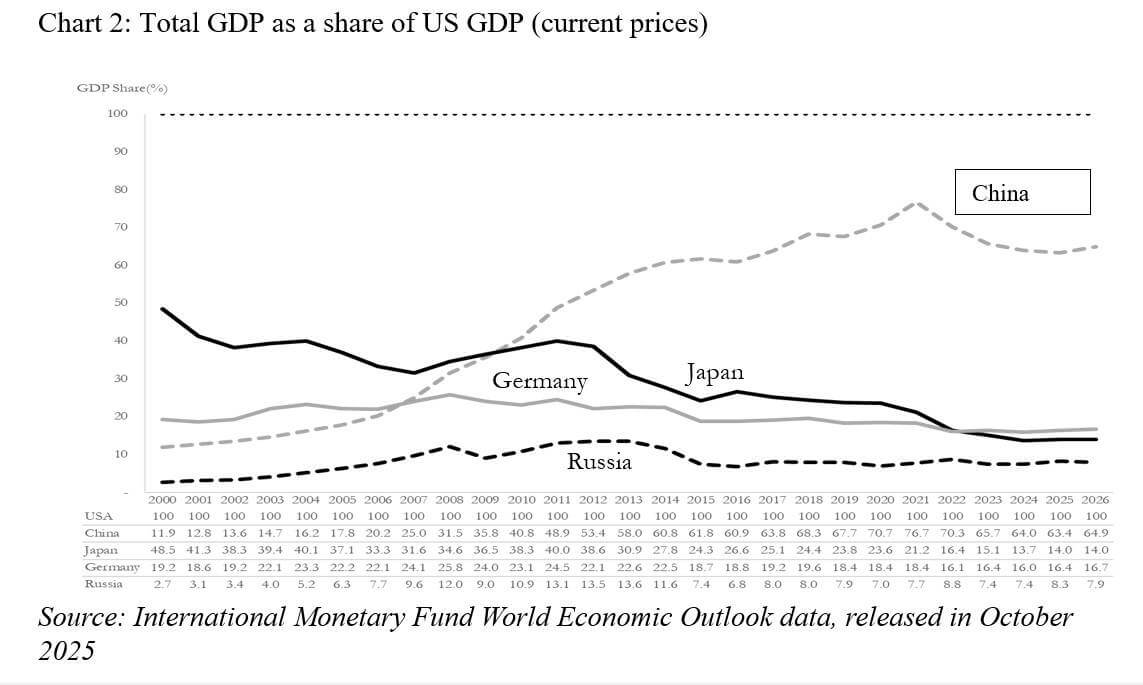

Moreover, the overall size of China’s economy is declining relative to that of the US (in current US dollars).

As Chart 2 shows, Chinese GDP grew from 12% of US GDP in 2000 to a peak of 76.7% in 2021, after which it began to decline – to 70.3% in 2022 and 63.4% this year.

The sudden drop in 2022 reflected the impact of COVID-19 lockdowns, but other factors have clearly been at play since then.

One such factor is America’s outperformance of most other economies.

While the US share of global GDP remains below its peak of 30% in the early 2000s, it has risen from 21.3% in 2011 to 25.2% in 2020 and reached 27.3% this year.

Renminbi depreciation is also relevant. The currency’s value declined from roughly 6.4 per dollar in 2022 to around 7.2 in mid-2023, and it has hovered around that level ever since.

Recent econometric analyses confirm that currency undervaluation is positively associated with growth of GNI per capita, but negatively associated with a country’s share of global GDP.

Economic Thucydides trap

Given the importance of GDP in determining an economy’s relative global power, this does not bode well for China.

While the country may yet be able to turn things around, it will not be easy – not least because of unfavorable demographics.

According to the United Nations’ World Population Prospects, China’s population is set to decline from its 2021 peak of 1.43 billion to 1.34 billion in 2040.

Over the same period, America’s population is expected to increase from 340 million to 370 million.

China may find itself ensnared in a kind of economic Thucydides trap: attempting to surpass an incumbent hegemon bent on keeping it down – and never quite succeeding

China’s leaders are well aware of these headwinds. The 15th Five-Year Plan aims to advance China’s transition from an economy dependent on traditional, labor-intensive manufacturing and infrastructure-led growth to a higher-value-added, innovation-driven model, fostering both development and security.

But while China has probably evaded the middle-income trap, it may yet find itself ensnared in a kind of economic Thucydides trap: attempting to surpass an incumbent hegemon bent on keeping it down – and never quite succeeding.

Keun Lee, a former vice chair of the National Economic Advisory Council for the President of South Korea, is Professor of Economics at Seoul National University.