The significant drop in the price of lithium in the past year has led to disruptions in the market. Lithium stands out from many other minerals due to its specificity of being irreplaceable in green transition projects.

While its recovery is expected in the second half of the year, all participants in the supply chain, particularly lithium producers, have been cautious due to the still high volatility of this market.

From the end of 2022 to January 2024, the price of lithium dropped by more than 80%, which caused significant shocks on the producer side.

The largest producers in Australia (the global leader with more than 50% of the world's production) have resorted to cutting costs, reducing investments and cutting their development plans due to low lithium prices.

Australian lithium leader Albemarle, for example, will cut capital expenditures by $300 million to $500 million compared to 2023.

In lithium exploitation, mining companies will rely on large capacities already in operation or preparation. However, they will refrain from opening greenfield projects because they are not feasible at the current low lithium prices.

A victim of a growth spurt

The lithium market fell victim to the 2020-2022 boom and high demand, which pushed prices to historic highs.

At its peak, the profit from the sale of a tonne of lithium was as much as 10 times higher than the cost of production (about $50,000 compared to about $5,000 per tonne).

The sharp drop in the price of lithium came as a result of a perfect storm, in which, at the same time, there was a drop in demand for electric vehicles and increased global production fuelled by high profits that led to a sharp increase in supplies, and therefore a drop in the price of raw materials.

The decline in demand for lithium is primarily caused by the decline in demand for EVs in China

The decline in demand for lithium is primarily caused by the decline in demand for EVs in China (the largest market) and the reduction of subsidies. China's EV market has increased by as much as 85% in 2022, primarily due to a low initial base. However, last year's growth was "only" 25%.

This trend continued at the beginning of 2024 when 25% fewer EVs were sold compared to last December, even though this was attributed to seasonal factors, that is, a drop in demand during the Spring Festival and Chinese New Year.

Chinese influence

The enthusiasm for lithium a few years ago was also fuelled by large incentives from governments globally (US, Europe, and China) to buy EVs.

The EV market has experienced a significant growth despite the continued high prices of EVs, which have proven to be a major factor in the decline in demand that is now evident.

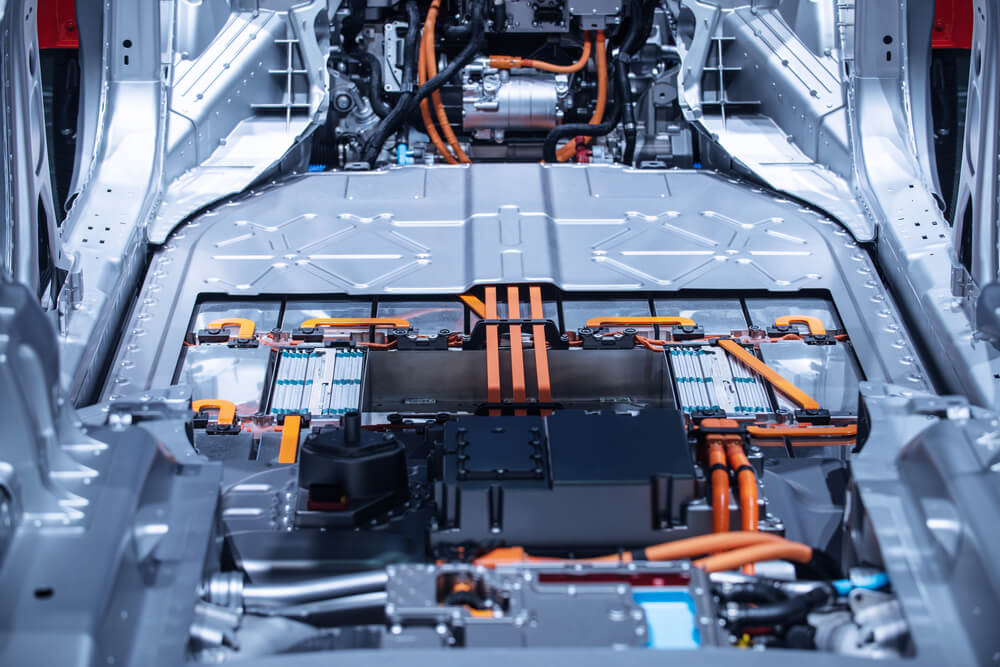

The disruption is primarily caused by China's still-present dominance in battery production (a critical component of EVs), where Chinese manufacturers hold 80% of the global market.

The lithium market is still considered new to international trade and is still developing, so fluctuations are to be expected

Significant government incentives in the Western EV markets (in the US and the EU) to encourage domestic production have not yet produced full effect.

Reducing lithium production (currently ongoing at the largest producers in Australia) will also lead to a decline in supplies, which, with the steady growth of demand for EVs, predicts a recovery and rise in the price of lithium on the global market.

The lithium market is still considered new to international trade and is still developing, so fluctuations are to be expected.

Lower profits, but long-term growth

In the long term, lithium producers and others in the supply chain could count on high and stable growth, given the proclaimed goals of decarbonisation and reduction of greenhouse emissions.

According to McKinsey, by the end of the decade, the demand for lithium-ion batteries will increase as much as 7 times to about 4,700 GWh (2030), most of which will be used in electric vehicles.

However, fluctuations in the market like the current one will be less frequent and less jumpy and will lead to stabilisation, with solid growth, but not with such large profits as they were only 2 or 3 years ago.

By the end of the decade, the demand for lithium-ion batteries will increase as much as 7 times

By the end of the decade, the demand for lithium-ion batteries will increase as much as 7 times

Current lithium prices should stabilise at $20,000 to $25,000 per tonne by 2027, according to S&P Global.

That is half the price of the "golden age" of 2021 and 2022 but almost double the current level of around $13,000 a tonne for lithium carbonate, the principal raw material for making EV batteries.

The decrease in profits and the simultaneous long-term expectations of stable growth in demand will make the production side of the chain rearrange and expand, probably with a series of mergers and sales.

Smaller projects and those that have only been active in the market due to its recent high growth are close to pulling out because of the current low prices and longer recovery they could not afford.