In recent months, Nvidia has become synonymous with the possibilities of modern technology and an optimistic view of the development of artificial intelligence.

In its report for the first quarter of 2025, the company announced a turnover of 44.1 billion dollars, representing a growth of 69 per cent compared to the same period last year. The data centre segment remained the engine of this growth, with a turnover of 39.1 billion, which increased by 73 per cent annually.

This dynamic also led to a record-breaking market value of $3.92 trillion, reached on 3 July, when Nvidia briefly overtook Apple to set a new all-time high for a single company.

Its presence in the S&P 500 index now stands at around seven per cent, meaning that any major movement in its share price has a direct impact on pension funds and the broader market indices.

The S&P 500 index is an aggregate measure of the performance of the 500 largest companies listed on the US stock exchanges (NYSE and Nasdaq).

These companies cover all key sectors of the economy, so this index is often used as an indicator of the general state of the US stock market and as a guide to global investment sentiment.

The centrepiece of AI infrastructure

Nvidia's business model is increasingly moving beyond making graphics cards for gamers to become the centrepiece of artificial intelligence infrastructure.

Key users of the chips include the world's largest technology companies, Microsoft, Amazon, Alphabet, Meta, and Tesla, which are looking for solutions to train large language models and process huge amounts of data.

The company announced that it will introduce new products based on the Blackwell architecture over the summer to further strengthen its position in the advanced processors market.

Blackwell is a new design of Nvidia’s graphics processor intended for data centres and artificial intelligence training. It enables significantly faster execution of AI tasks and better energy efficiency thanks to improved "tensor" cores and enhanced inter-chip connectivity.

Despite demand growing steadily, Nvidia faces significant regulatory challenges. In April, the US authorities imposed restrictions on the export of chips intended for the most advanced AI applications to China.

Nvidia plans to launch a cheaper version of the Blackwell chip for the Chinese market

The ban also affected the H20 model, for which the company estimated that it would lose around 15 billion dollars in sales as a result of this measure.

Nvidia's official report states that $2.5 billion in revenue was lost in the first quarter due to this regulation and that a further $8 billion in revenue is expected to be lost in the second quarter.

To mitigate these losses, Nvidia plans to launch a cheaper version of the Blackwell chip for the Chinese market. This version uses standard GDDR7 memory instead of the more modern and expensive HBM technology and achieves a transmission of around 1.8 terabytes per second. In this way, Nvidia retains around 13% of the market share while respecting the American export restrictions.

The race is intensifying

The situation is also changing on the competitive side. TSMC and Samsung are rapidly expanding their capacities for the production of specialised AI chips, while in China, the two companies, Moore Threads and MetaX, are planning a series of IPOs worth over USD 1.6 billion to finance the development of their own GPU solutions.

Freeing up funds for domestic actors could further intensify the global semiconductor race and reduce Nvidia's monopoly control.

Analysts at Wedbush Securities (an independent American investment bank and brokerage firm) expect Nvidia to reach a market capitalisation of four trillion dollars as early as this summer if its shares rise by around three per cent, and over the next eighteen months the value could jump to five trillion if the momentum of investment in AI infrastructure is maintained.

Nvidia has announced plans to invest around USD 500bn in equipment and production capacity expansion

However, any forecast must also take possible macro risks into account. Global interest rates and a possible tightening of monetary policy could make it more difficult to refinance large liabilities for the expansion of production capacities.

At the same time, the rise of domestic competitors in China and the possibility of new export restrictions are causing investors to consider the scenario of a reduced profit margin.

Nvidia has announced plans to invest around USD 500bn in equipment and production capacity expansion over the next four years to meet the growing demand for AI chips.

Nvidia’s undisputed position

If the company manages to maintain the pace of innovation, i.e., regularly bringing new generations of GPU solutions to market while balancing global partnerships and regulatory obligations, its position will remain undisputed in the coming quarters.

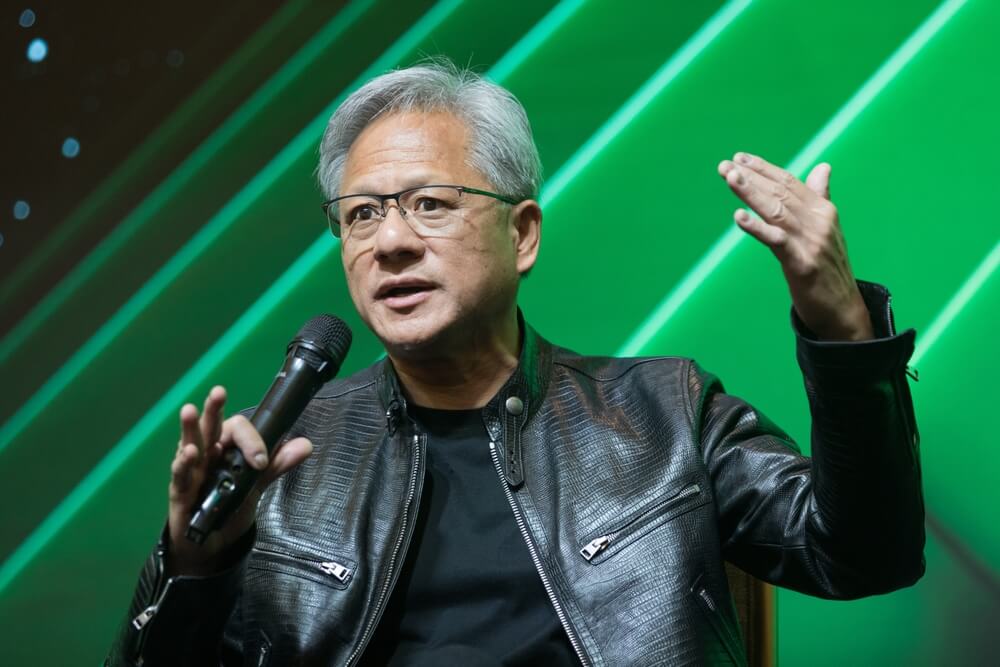

Nvidia has become an indispensable parameter of global economic and technological dynamics - Jensen Huang

Nvidia has become an indispensable parameter of global economic and technological dynamics - Jensen Huang

Nvidia has already redefined the standard for valuing technology leaders, forcing the markets to evaluate companies through the lens of AI capabilities.

Whether the market capitalisation will actually reach four or perhaps even five trillion dollars depends on the company's ability and ambition to simultaneously support growth, control costs, and overcome potential political obstacles.

In any case, Nvidia has become an indispensable parameter of global economic and technological dynamics, and its future development will shape the attitude of investors around the world.